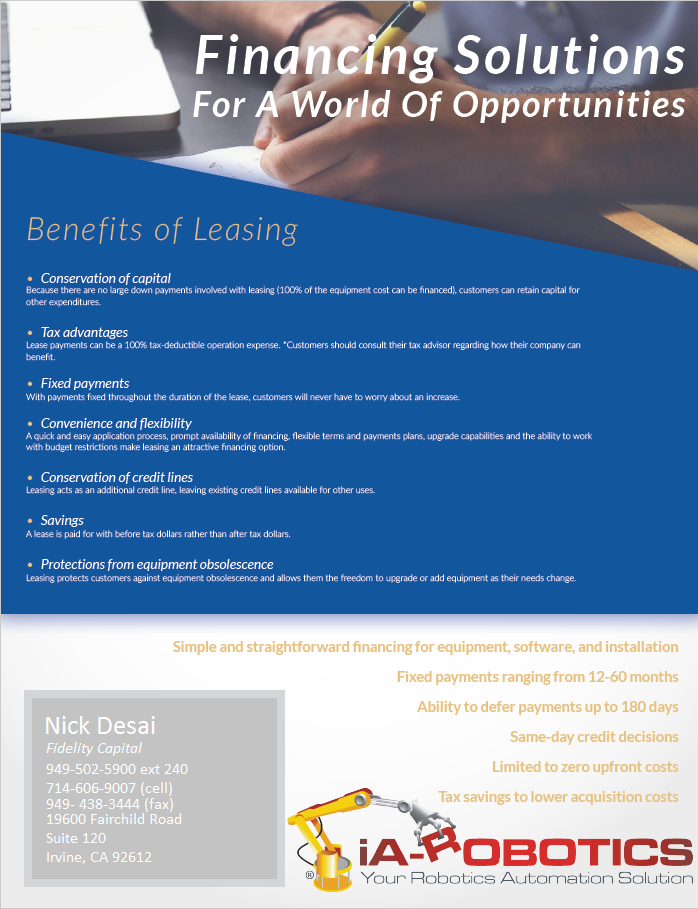

Why Finance?

- Simple and straightforward financing for equipment, software, and installation

- Fixed payments ranging from 12-60 months

- Ability to defer payments up to 180 days

- Same-day credit decisions

- Limited to zero upfront costs

- Tax savings to lower acquisition costs

Benefits of Leasing

Conservation of Capital – Because there are no large down payments involved with leasing (100% of the equipment cost can be financed), customers can retain capital for other expenditures.

Tax Advantages – Lease payments can be a 100% tax-deductible operation expense. *Customers should consult their tax advisor regarding how their company can benefit.

Fixed Payments – With payments fixed throughout the duration of the lease, customers will never have to worry about an increase.

Convenience & Flexibility – A quick and easy application process, prompt availability of financing, flexible terms and payments plans, upgrade capabilities and the ability to work with budget restrictions make leasing an attractive financing option.

Conservation of Credit Lines – Leasing acts as an additional credit line, leaving existing credit lines available for other uses.

Savings – A lease is paid for with before tax dollars rather than after tax dollars.

Protections From Equipment Obsolescence – Leasing protects customers against equipment obsolescence and allows them the freedom to upgrade or add equipment as their needs change.